The JRB proudly announces an expansion of our Complimentary Insurance Program. We now offer a free, interactive, online legal tool you can use to:

The JRB proudly announces an expansion of our Complimentary Insurance Program. We now offer a free, interactive, online legal tool you can use to:

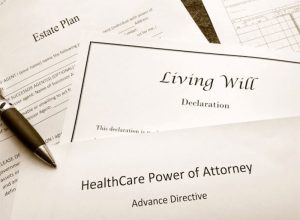

Write your Will

Draft a Power of Attorney

Create a Healthcare Directive

Prepare a Living Trust

The forms generated by the tool are customized by state so they apply to the jurisdiction in which you live. The forms available to you will vary depending on the state in which you reside. These interactive forms are sponsored by the Mutual of Omaha Insurance Company, the underwriter of the JRB’s Complimentary Insurance Program and hosted by Epoq, Inc.

Here’s how the interactive tool works.

- Go to www.willprepservices.com.

- Register using the code MUTUALWILLS.

- Complete the Registration Form, set up an account and select the form you want to create.

- Choose your state from the drop-down menu.

- Answer the questions, download, print and share the document immediately. The form describes each of the choices you will need to make and summarizes some of the implications of each selection.

- Remember to update your documents with any major life changes, such as marriage, divorce, the birth of a child or the death of a beneficiary.

- Make the document legally binding by reviewing it with state officials or legal counsel.

Last Will and Testament

Based on your state, you will find forms such as:

- Last Will and Testament for a Married Person.

- Last Will and Testament for a Single Person.

- A Codicil – A codicil is sort of a legal “P.S.” to a Will. It allows you to revoke a clause in your Will, substitute a new clause or add an entirely new provision without completely rewriting your Will.

- Funeral Directive – This document allows you to specify directions for your funeral arrangements and disposal of your remains.

Power of Attorney

Based on your state, you will find forms such as:

- Durable Power of Attorney for Finances – A Durable Power of Attorney remains in effect if you are incapacitated. This Power of Attorney allows someone to act on your behalf in financial matters. It does not authorize anyone to make medical or other health care decisions for you.

- Instructions to Custodian of Power of Attorney – The custodian holds your Power of Attorney until it is needed. It includes which Powers of Attorney have been created, when the custodian delivers the document and the date you executed the Power of Attorney.

- Revocation of Power of Attorney – This document revokes or legally cancels and voids an existing Power of Attorney.

Healthcare Directives

Based on your state, you will find forms such as:

- Advance Health Directive – Allows you to name a representative to make decisions about your medical care should you become incapacitated. You can instruct your representative regarding the medical services, end-of-life care and organ donation arrangements you want.

- Living Will and Health Care Power of Attorney – The Health Care Power of Attorney allows you to name someone to make decisions about your medical care, including life support, if you are not able to do so. The Living Will states your wishes about medical care if you are incapacitated.

- HIPAA Authorization – The Health Insurance Portability and Accountability Act (HIPAA) is a federal law that sets privacy standards to protect your medical records. This form allows you to identify people who can have access to your medical records in the event that you are incapacitated.

Living Trust

Based on your state, you will find forms such as:

- Living Trust for a Married Couple – A Living Trust allows you to provide instructions on how to divide a couple’s assets after both people die. The advantage of a Living Trust is that it avoids probate. A Living Trust also requires you to transfer ownership of your assets to a trust for which you are the trustee. As trustee, you retain full rights to manage your assets while you are alive. Under a Living Trust for a married couple, the surviving spouse can change the way the assets are distributed when the surviving spouse dies.

- A-B Living Trust for a Married Couple – An A-B Living Trust limits the ability of the surviving spouse to change how the assets are distributed when the first spouse dies.

- Living Trust for a Single Person – Because there is no spouse, the assets in a single person’s Living Trust are transferred directly to their beneficiary when they die.

The JRB knows that our plan participants have strong feelings about the end-of-life medical care they will receive and the distribution of their assets when they pass away. To maximize the chance that your wishes are followed, it is critical to put the proper legal documents in place.

These interactive forms will get you well on your way to this goal. We hope you find this enhancement of the JRB’s Complimentary Insurance Program useful. Please send any feedback to staff@jrbcj.org or call 888-JRB-FREE (572-3733).

February 2020